In the wake of the early 2020s, during which COVID-19 had a profound impact on markets and daily life, many Americans found themselves working from home. This shift not only changed work culture but also sparked a surge in home improvement projects. With more time at home and fewer options for leisure, many tackled long-delayed upgrades from simple paint jobs to full-scale kitchen remodels. Home Depot (HD) became a crucial resource during these times, experiencing significant growth due to its expansive retail network and strategic positioning.

During the pandemic, with professional contractors harder to book due to labor shortages and stay-at-home orders, DIY projects became more appealing. With over 2,300 locations across the U.S., Home Depot was ideally situated to cater to the surge of home improvers and professional builders alike. The retailer’s proximity to suburban communities allowed it to serve both casual DIY enthusiasts and seasoned contractors.

As COVID-19 restrictions eased and people returned to their workplaces, the housing market experienced a boom, further benefiting Home Depot. The company, known for its wide range of building materials and home improvement products, was well-prepared to support both individual and professional customers. This dual focus helped sustain its growth trajectory even as the pandemic’s immediate impacts began to wane.

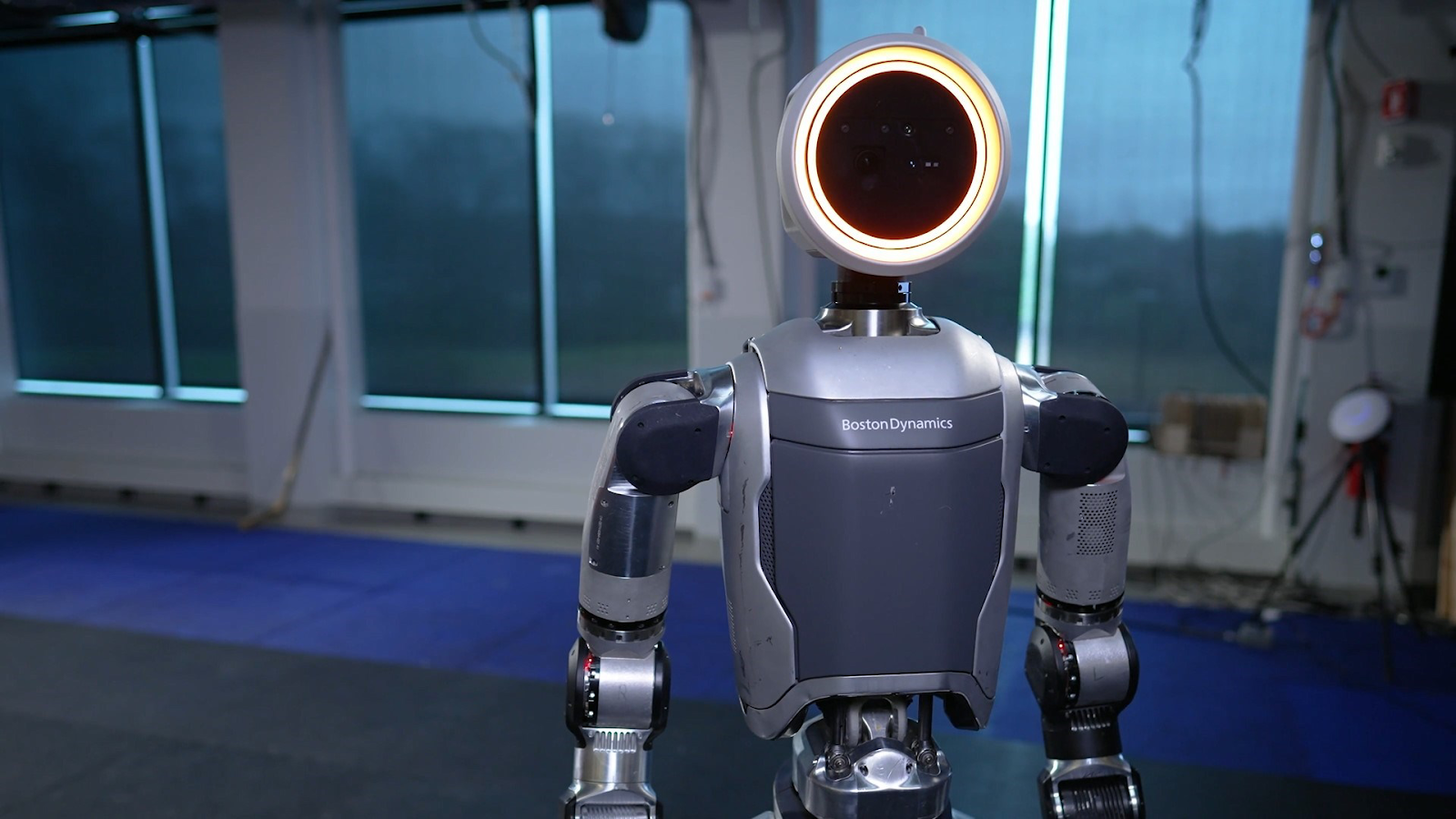

Capitalizing on its pandemic-era growth, Home Depot announced ambitious expansion plans in March. These included the opening of several large distribution centers aimed specifically at professional home improvement contractors. These centers are designed to streamline access to essential materials such as lumber, insulation, and roofing shingles, providing convenience and efficiency for larger-scale projects.

Moreover, Home Depot made a significant strategic move by acquiring SRS Distribution of McKinney, Texas, for $18.25 billion. This acquisition, the largest in Home Depot’s history, aims to strengthen its foothold in the professional market, offering a broad range of supplies, from landscaping tools to pool materials.

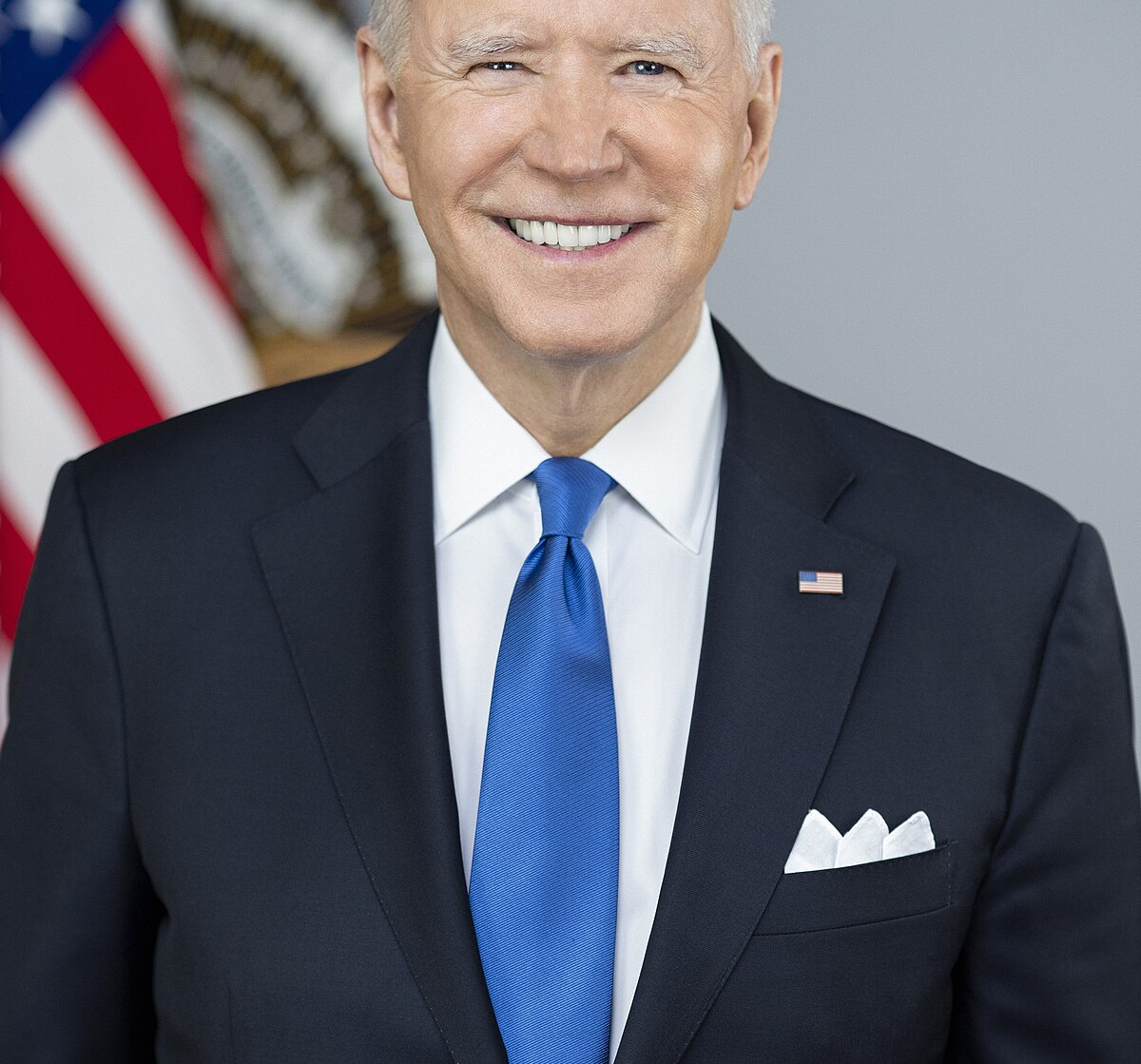

Despite these optimistic developments, Home Depot faced some financial headwinds, as reported in its Q1 2024 earnings. The company missed revenue expectations, with a notable decline in comparable store sales in the U.S. Management attributed this downturn to the high interest rates, which have tempered the enthusiasm for more expensive home improvement projects. CFO Richard McPhail expressed hope that upcoming reductions in interest rates might revive consumer interest and spending in the sector.

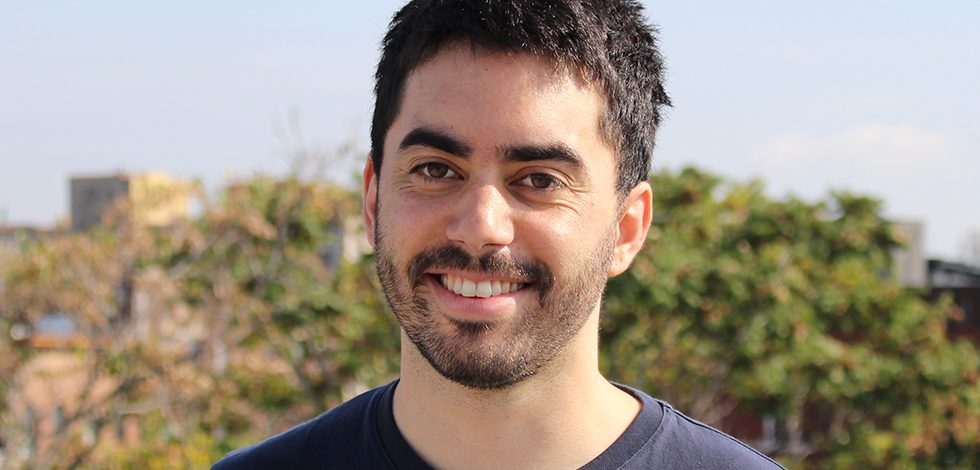

CEO Ted Decker reiterated the challenges posed by the economic climate. This includes, in particular, the Federal Reserve’s interest rate policies, which have cooled demand for large-scale home renovations. Decker emphasized a strategic focus on adapting to these economic variables while maintaining a neutral stance on the housing market’s immediate future.

Despite the economic pressures and a dip in consumer spending on home improvement, Home Depot remains optimistic about the future. This is predominantly due to the onset of the spring and summer seasons—prime times for home projects. The company continues focusing on areas within its control, adapting strategically to market trends and consumer needs.

As Home Depot navigates through these complex economic landscapes, it demonstrates resilience and adaptability—qualities that have defined its success through the unpredictable times of the early 2020s and beyond. The company’s efforts to cater to both individual DIYers and professional contractors are likely to help it maintain a strong position in the market, regardless of short-term economic fluctuations.