Image credit: Unsplash

Dimon’s Perspective on Global Conflicts and Economic Risks

Jamie Dimon, the head of JP Morgan, recently sounded an alarm, warning that the world might be edging toward its gravest threat since World War II. This looming danger, he pointed out, could stall economic progress and even endanger lives.

In his yearly letter to shareholders, Dimon looked back on recent global trends. Things seemed to be getting safer and stronger, he said. But that changed quickly when Russia invaded Ukraine in February 2022.

Dimon has noticed that people often overreact to big disasters, assuming they’ll wreck the global economy. But this time, he warns, “We’re staring down risks like we haven’t seen since World War II. We really need to take this seriously.”

While the JP Morgan boss did not speak about Israel’s recent assault on Gaza, he added that the “abhorrent attack on Israel and ongoing violence in the Middle East” had, in fact, “punctured many assumptions about the direction of future safety and security, bringing us to this pivotal time in history.”

The letter to investors touched on numerous subjects, from politics and interest rates to artificial intelligence. However, amid the insights, Dimon warned about the recent breakdown in international relations, which “may end up having virtually no effect on the world’s economy or it could potentially be its determinative factor.”

IMF’s Warning and Future Economic Projections

Furthermore, Dimon said, “The ongoing wars in Ukraine and the Middle East could become far worse and spread in unpredictable ways. Most important, the specter of nuclear weapons — probably still the greatest threat to mankind — hovers as the ultimate decider, which should strike deep fear in all our hearts.”

He added, “The best protection starts with an unyielding resolve to do whatever we need to do to maintain the strongest military on the planet — a commitment that is well within our economic capability.”

Dimon’s warnings are similar to those issued by the International Monetary Fund (IMF), which warned in December that the global economy was on the verge of a second Cold War. The IMF statement said this could “annihilate” our incredible advancements since the Soviet Union collapsed many years ago.

The first deputy managing director of the IMF, Gita Gopinath, spoke of a “turning point” for the world at the time. The statement came as tensions amplified between the world’s most powerful nations and the cumulative splitting of the world economy into regional power blocs centered around China and the US risked eliminating trillions of dollars in global output.

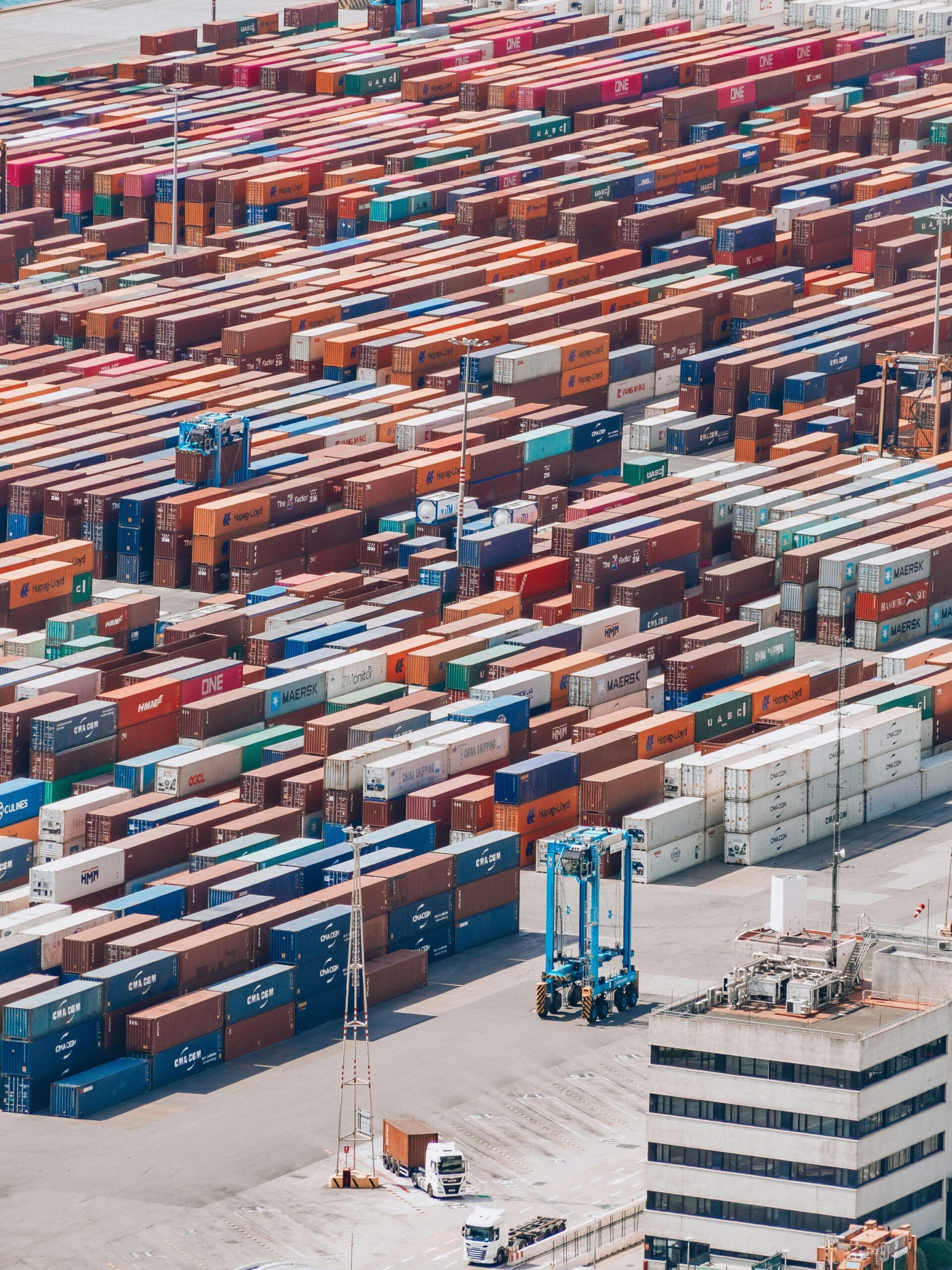

Gopinath said, “If we descend into Cold War two, knowing the costs, we may not see mutually assured economic destruction. But we could see an annihilation of the gains from open trade.”

According to Dimon, a surge in government spending tied to military expenditures, health care costs, climate transition plans, and fluctuating global supply chains could ultimately result in “stickier inflation and higher rates than markets expect.”

He also said that JP Morgan had contingency plans for US interest rates (currently between 5.25% and 5.5%) to spike greater than 8% or drop as low as 2%. Dimon added, “We have ongoing concerns about persistent inflationary pressures and consider a wide range of outcomes to manage interest rate exposure and other business risks.”