Image credit: Unsplash

HBC, the parent company of Saks Fifth Avenue, has just acquired Neiman Marcus for $2.65 billion. This merger joins two of the most iconic names in upscale department stores.

HBC also owns Canada’s Hudson’s Bay. It will merge with Neiman Marcus, which owns the upscale Bergdorf Goodman. The new company, called Saks Global, will be led by Marc Metrick who is currently heading Saks.com. This move aims to combine the strengths of both brands to remain competitive in the ever-changing luxury market.

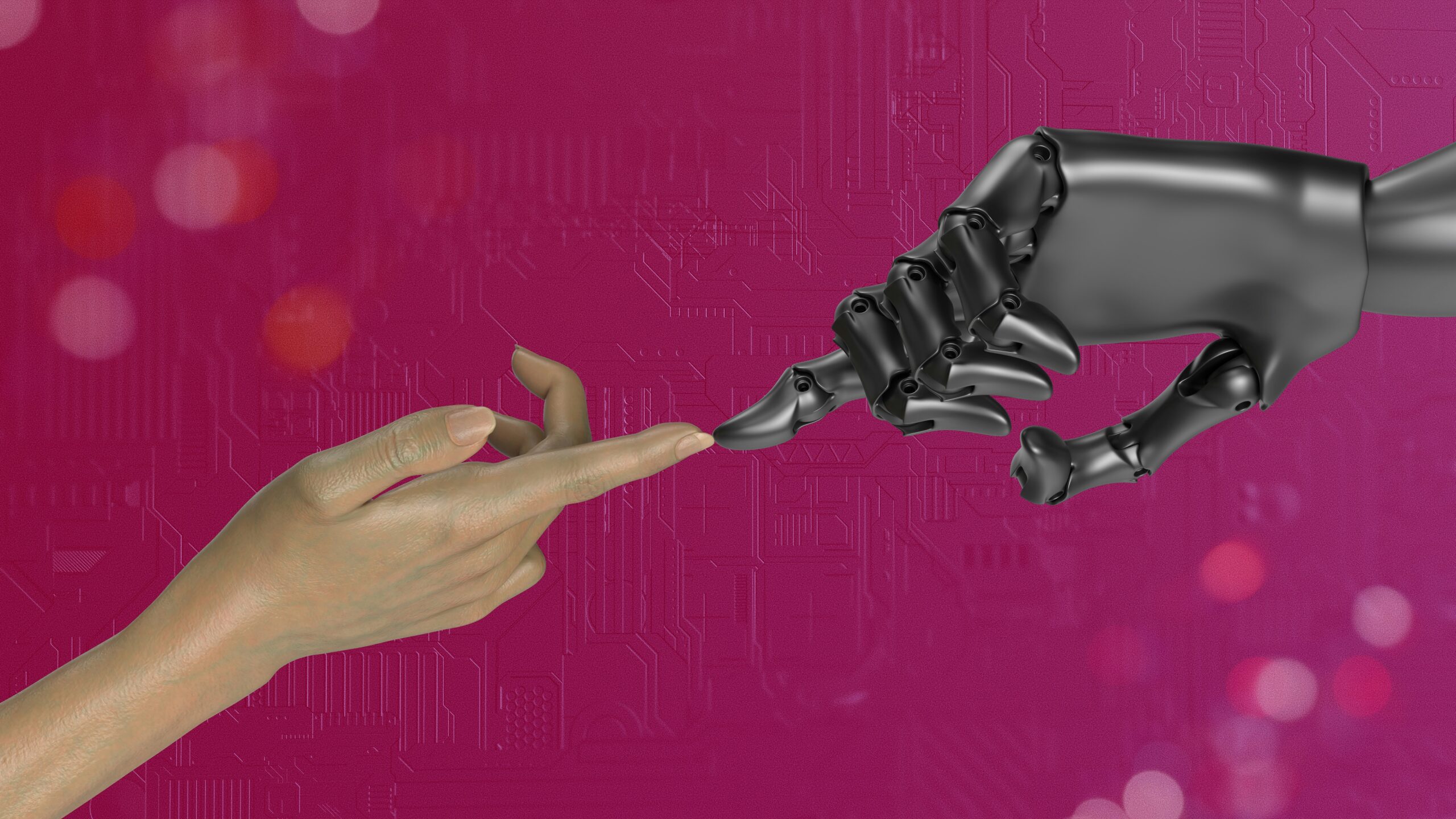

To escalate the technology capabilities of the deal, Amazon and Salesforce will take minority stakes in the new company. Amazon will provide technology and logistics support, while Salesforce will focus on customer relationship management. These additional partnerships demonstrate the critical role of technology will continue to play in the retail sector.

Both Saks and Neiman Marcus have faced significant challenges recently. Neiman Marcus was the first major department store to file for bankruptcy at the start of the COVID-19 pandemic (although it later reemerged under new ownership.) Initially, the pandemic created a surge in luxury spending. However, that surge has since weakened with more shoppers opting to purchase to online.

Luxury brands are choosing to bypass department stores, connecting directly with consumers by opening their own stores. This trend has put extra pressure on traditional department stores to innovate and adapt.

HBC’s CEO, Richard Baker, highlighted the role of technology in this transformation, saying, “This is an exciting time in luxury retail, with technological advancements creating new opportunities to redefine the customer experience.” The company plans to use artificial intelligence to personalize shopping experiences both online and in physical stores.

The luxury retail industry is becoming more competitive. For example, rivals like Macy’s and Nordstrom are also changing their strategies. Macy’s, which owns Bloomingdale’s, has been closing stores and focusing more on its luxury segment as a result of investor pressure. Meanwhile, the family that owns Nordstrom is exploring options to take the company private.

Currently, Saks Fifth Avenue operates 39 stores across North America, along with its off-price outlet, Saks Off 5th. Neiman Marcus owns 36 stores and two Bergdorf Goodman locations. This merger will likely face intense scrutiny from federal regulators, who recently sued to block high-profile mergers between market leaders in other industries. Examples of this include the attempted mergers of grocery giants Kroger and Albertsons and the proposed acquisition of Capri Holdings (owner of Versace and Michael Kors) by Tapestry (owner of Coach and Kate Spade).

Additional challenges include ensuring a seamless integration of both companies’ operations, cultures, and customer service philosophies. Overcoming this hurdle will be crucial to both maintaining its brand image and loyal customer base. The merged companies will have to manage any potential overlaps in their product offerings and store locations to avoid internal competition.

This new focus will be on creating a unified brand that appeals to the modern luxury shopper. Luxury clients often expect more than just products, they want experiences that resonate with their lifestyle. As a result, the merger isn’t just about expanding market share. It’s about transforming how luxury retail operates in the digital age.